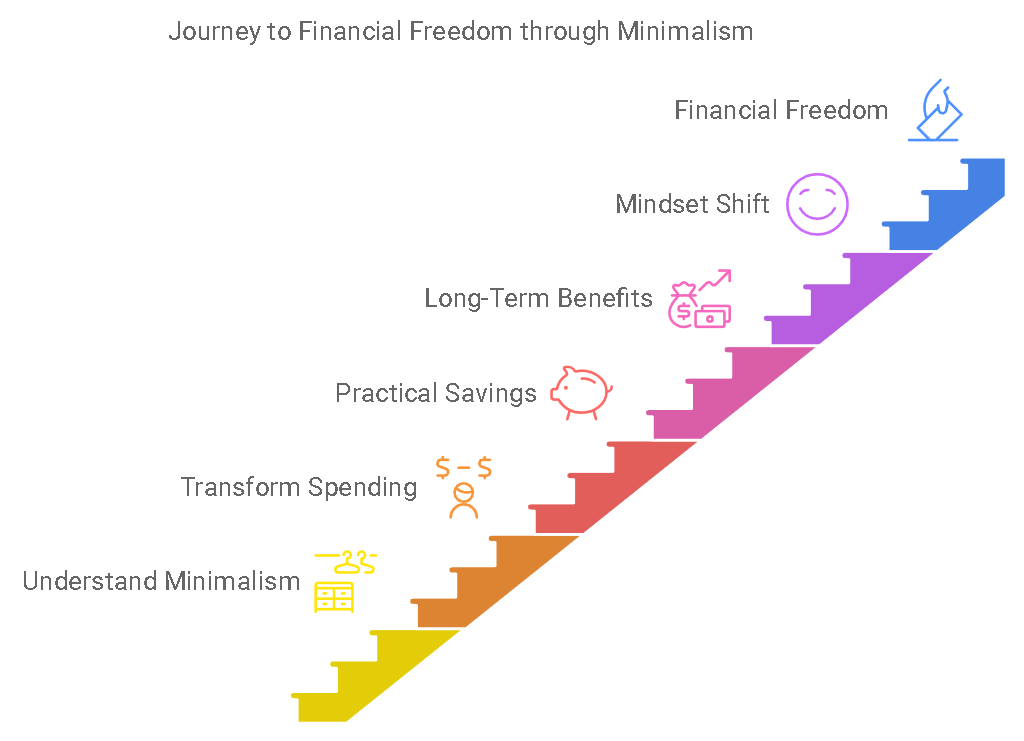

Embracing Minimalism: Unlocking Financial Freedom by Simplifying Your Life

Have you ever looked around your room and thought, “Wow, I have way too much stuff!”?

Well, that’s where minimalism comes in! Minimalism isn’t just about cleaning up or getting rid of things; it’s a way of living that helps us focus on what really matters in our lives.

Imagine having less clutter around you and more money in your pocket. Sounds great, right?

In this blog post, we’re going to explore how living with less can actually help you save money.

By cutting out unnecessary expenses and focusing on the things that truly bring you joy, you can enjoy more financial freedom. So, let’s dive into how a simpler lifestyle can lead to big savings and a happier life!

Understanding Minimalism

Have you ever heard the word minimalism and wondered what it really means? Well, minimalism is all about living simply and intentionally. It’s like cleaning out your room but for your whole life! Instead of having a lot of things that you don’t use or need, minimalism encourages you to keep only what truly matters to you.

This way, you can enjoy a simpler life without all the extra stuff getting in the way. Now, some people might think that minimalism means you have to give up everything and live in a tiny space with just a few clothes.

But that’s not true! Minimalism isn’t about deprivation; it’s about making choices that help you feel happier and more focused. It’s about finding joy in less, not feeling sad about what you don’t have.

Living with less can also bring some amazing benefits beyond just saving money.

For example, when you declutter your space and mind, you might feel less stressed and more clear-headed. Imagine how nice it would be to have a calm and tidy room where you can think and relax! So, let’s explore how minimalism can help us not only with our finances but also with our overall happiness!

The Financial Benefits of Minimalism

Have you ever thought about how much money you spend on things you don’t really need? Well, that’s where minimalism can help! When you choose to live a simpler life, it means buying only what you truly need.

This can lead to less spending on material goods. Instead of making impulse purchases—like those cool toys or trendy clothes that catch your eye—you’ll think twice and only buy what really matters to you. This way, your wallet stays a little fuller!

Living simply can also help you have a lower cost of living.

If you decide to live in a smaller space, you’ll save money on rent or mortgage payments. Plus, with fewer things to take care of, your utility bills for electricity and water might go down too! Imagine having more money left over each month just because you chose to keep things simple.

Another great benefit of minimalism is that it can help you accumulate less debt. When you focus on what’s important and avoid buying unnecessary stuff, you won’t feel the urge to use credit cards for things you don’t need.

This means fewer bills to worry about and more money saved for the things that truly matter in your life.

So, by embracing minimalism, not only can you save money, but you can also enjoy a happier and less stressful life! Let’s keep exploring how living with less can lead to big financial benefits!

Minimalist Room Image

How Minimalism Transforms Your Spending Habits

Have you ever thought about how you spend your money? Well, minimalism can really change the way we think about our spending! When you embrace a minimalist lifestyle, it helps you shift your priorities from buying lots of stuff to enjoying experiences.

Instead of spending money on toys or clothes that might only make you happy for a little while, you can save up for fun activities like going to the movies with friends or visiting a cool museum. These experiences can bring you joy that lasts much longer! Another way minimalism helps with spending is through mindful consumption.

This means being careful about what you buy and choosing quality over quantity. Instead of getting a bunch of cheap items that might break easily, you can save your money to buy something that’s really well-made and will last a long time. This way, you end up saving money in the long run because you won’t have to keep replacing things!

Finally, minimalism encourages budgeting with purpose. This means thinking about what’s important to you and making sure your spending matches your values and goals.

If you love animals, maybe you’ll want to save money to donate to a local animal shelter. By aligning your spending with what matters most to you, you ensure that your financial resources are used wisely and help you reach your dreams.

So, by adopting minimalism, you can transform how you spend your money, focusing on what truly makes you happy and fulfilled! Let’s keep exploring how living with less can lead to a happier and more financially smart life!

The Financial Benefits Of Minimalism

Practical Ways Minimalism Can Save You Money

Have you ever looked around your room and thought, “I have way too much stuff!”? Well, one of the coolest things about minimalism is that it can actually help you save money! Let’s talk about some practical ways living with less can put extra cash in your pocket.

First up is decluttering and selling unused items. When you clear out all those toys, clothes, and gadgets you don’t use anymore, you can sell them! This means you can make some extra money while also making space for the things you really love. Imagine turning that pile of old toys into cash for something fun or useful!

Next, consider living in smaller spaces. If you decide to move to a smaller home or apartment, you can save a lot of money on rent or mortgage payments. Plus, with less space to fill up, you won’t feel the need to buy more stuff to decorate!

This can really help your budget stay healthy.

Finally, let’s talk about reducing subscription services and bills.

Sometimes we sign up for things like streaming services, magazines, or apps that we don’t even use anymore. By taking a look at what you really need and cutting out the extras, you can save money every month. It’s like giving your budget a little makeover!

So, by decluttering your space, living smaller, and trimming those unnecessary bills, minimalism can help you save money and enjoy a happier life with less stress. Let’s keep exploring how living with less can lead to even more savings!

The Long-Term Financial Impact of Minimalism

Hey there! Let’s talk about how living with less stuff can help you save more money in the long run. It’s like planting a money tree that grows bigger and stronger over time!

First, let’s chat about emergency savings. You know how grown-ups always talk about having a “rainy day fund”?

Well, when you live a minimalist life, it’s easier to save up for those unexpected surprises. Since you’re spending less on things you don’t really need, you can put more money into your piggy bank for emergencies. It’s like having a superhero shield to protect you when things get tough!

Next up is investing more wisely.

When you save money by living simply, you can use that extra cash to make your money grow even more! It’s like planting seeds in a garden. You can ask your parents or a trusted adult to help you learn about investing in things like stocks or savings accounts that earn interest.

This way, your money works hard for you while you’re busy having fun and learning new things.

Lastly, minimalism can help you achieve financial freedom faster. This means you can pay off any money you owe more quickly and start saving for your dreams sooner. Imagine being able to buy a car, go to college, or even travel the world without worrying about money!

By living with less now, you’re setting yourself up for an awesome future where you have more choices and fewer money worries.

So, by embracing minimalism, you’re not just saving a few dollars here and there. You’re building a strong foundation for a happy and secure financial future. Isn’t that exciting?

Let’s keep exploring how living with less can lead to so much more in life!

How to Get Started with Minimalist Finances

Are you ready to start your journey toward minimalism and save some money? It might sound a little tricky at first, but it’s actually super fun and easy! Let’s break it down into three simple steps to help you get started with minimalist finances.

First, you need to evaluate your current financial situation. This means taking a good look at where your money is going each month. You can write down all your expenses, like snacks, games, or even subscriptions.

Once you see where your money is going, you can figure out where you can cut back. It’s like being a detective for your own money! Next, it’s time to start small! You don’t have to change everything all at once. Pick one area to declutter, like your wardrobe or your digital subscriptions.

Maybe you can go through your closet and find clothes you don’t wear anymore. You can donate them or even sell them for some extra cash!

Starting small makes it easier and less overwhelming. Finally, let’s talk about adopting a mindset shift. This means changing the way you think about spending. Instead of always wanting the latest toys or gadgets, focus on what really brings you joy and adds value to your life.

Ask yourself if something is truly important to you before buying it. This way, you’ll be happier with what you have and save money at the same time! So, by evaluating your finances, starting small, and shifting your mindset, you’ll be well on your way to enjoying the benefits of minimalist finances! Let’s keep exploring how living with less can lead to a happier and more financially smart life!

Conclusion

We’ve learned so much about how living with less stuff can actually help us have more money and freedom. Isn’t that cool? Let’s quickly remember the awesome things we discovered:

- Minimalism helps us spend less on things we don’t really need.

- It makes our living costs lower, which means more money in our piggy banks!

- We can focus on buying quality things that last longer, saving money over time.

- It’s easier to save for emergencies and fun experiences.

- We can invest more and work towards our big dreams faster.

Now, here’s a fun challenge for you: Take a look around your room or ask your parents about your family’s spending habits. Are there things you could live without? Maybe you could start a “minimalism adventure” by decluttering one small area, like your toy box or bookshelf. Remember, living with less isn’t about giving up things that make you happy. It’s about choosing what’s really important to you and your family. By doing this, you can save more money and have more freedom to do the things you love! So, are you ready to try a little bit of minimalism in your life? It could be the start of an exciting journey towards having more money for the things that really matter to you. Let’s get started and see how living with less can lead to so much more!

Transform your financial journey with our Finance & Budget Planner, designed to help you take control of your finances and achieve your financial goals. This comprehensive planner includes a variety of tools and trackers to simplify budgeting, saving, and expense management.

Key Features:

- Monthly Income and Expense Trackers: Keep a detailed record of your income sources and monthly expenses, ensuring you stay on top of your financial commitments.

- Bill Payment Tracker: Never miss a due date again! Organize your bills with due dates, amounts, and payment statuses for easy management.

- Savings Goals Section: Set specific savings targets and track your progress throughout the year, helping you stay motivated and focused on your financial objectives.

- Weekly Savings Tracker: Monitor your weekly savings efforts to build a habit of saving consistently.

- Debt Payment Tracker: Manage your debts effectively by tracking payments, balances, and due dates to work towards becoming debt-free.

- Shopping List & Donation Tracker: Organize your shopping needs while keeping track of charitable contributions to stay aligned with your values.

- Financial Calendar: Plan out important financial dates and deadlines to maintain a clear overview of your financial landscape.

- No Spend Challenge: Challenge yourself to reduce spending with structured goals and tracking to foster mindful spending habits.

This planner is perfect for anyone looking to improve their financial literacy, manage their budget more effectively, or simply gain peace of mind regarding their finances. Whether you’re saving for a vacation, planning for retirement, or aiming to pay off debt, the Finance & Budget Planner is your essential companion on the path to financial success. Start organizing your finances today and watch as you move closer to achieving your dreams!